What is a holding company?

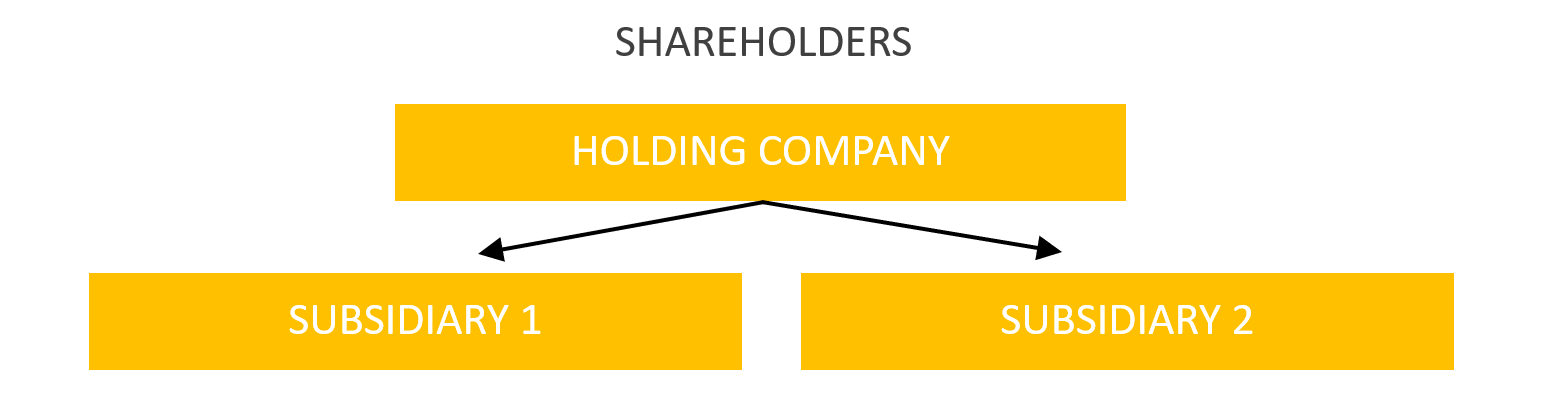

A holding company is usually a company set up to hold and protect investments in valuable assets, such as property, intellectual property (including trademarks, registered designs etc), spare cash, and to own investments in subsidiary entities.

Normally a holding company doesn’t do any trade itself, but it owns shares in subsidiary companies, which will often be doing the trade.

It allows businesses to separate trading risk (in the trading subsidiaries), from valuable assets (held in the holding company), and is also a neat way to separate different arms of the business which might be operating with different business models, or in different markets, helping to provide definite separation of different areas of the business.

Setting up a holding company can bring many advantages such as:

A holding company represents a great opportunity to separate valuable assets, such as property, intellectual property (including trademarks, registered designs etc), property and spare cash from the inherent trading risk in the trading companies. A holding company acts as a barrier, which would make it harder for someone making a spurious claim against a trading company to access the valuable assets which are held in the holding company.

Separate ownership of different assetsIntroducing a holding company allows you to separate out the ownership of different assets held within the group. For example, you might have a property which is currently held in a trading company, and you might want to introduce some employees as new minority shareholders [any links to articles about this], and you don’t want them to have a stake in the property. In this case, a holding company allows you to split out the property and ensures the new shareholders only own a share of the assets you want them to hold a share of.

Tax benefits Normally you can transfer cash and assets between different entities within a group without incurring additional tax charges, and dividends can be paid from the subsidiary up to the holding company tax-free. Creating a group can also allow group loss relief to be claimed, so if one entity is making a loss, and another is making a profit, the losses and profits can be offset within the group.

Buying out a business partner and succession planning You might be looking to buy out a business partner, and wondering how you’re going to fund the payout for the exiting shareholder's shares in an effective and tax-efficient way. Using a holding company can be a great way to achieve a shareholder buyout in a tax-efficient and flexible way, using company funds. You can find out more in this article on ‘How to fund a business partner buyout’.

If you would like further guidance on shareholder buyouts or to book a free consultation to discuss your specific requirements with one of our tax consultants - please fill out the form below

Please note: This article is provided for information only and was correct as at time of writing (14/04/23). Any lists and details provided above are not exhaustive and are not intended to be full and complete guidance. No action should be taken without consulting detailed legislation or seeking independent professional advice. Therefore no responsibility for loss occasioned by any person acting or refraining from action as a result of the material contained in this article can be accepted.

Share Article

You give us 30 minutes of your time. We'll give you growth and a plan

It's easy to book an initial consultation - just provide some brief details, and your preferred date and time, and we'll reply by email to confirm your appointment.

Contact us